March 06

1. PAYMENTS BANK IN INDIA

Syllabus : GS III Economy, Payments Bank and Money Laundering

Why in News

Paytm Payments Bank Limited (PPBL) faced a ₹5.49 crore fine from the Financial Intelligence Unit (FIU) due to extensive illegal activities. Cyber Crime Station in Hyderabad filed FIRs against these entities for engaging in illegal acts, including organizing online gambling and channeling the proceeds through bank accounts associated with the payments bank. The FIU also highlighted the bank’s failure to establish an internal system to detect and report suspicious transactions as required by Prevention of Money Laundering Act.

Paytm Payments Bank

PPBL, an Indian payments bank, was established in 2017 with its headquarters situated in Noida. It obtained a license from the Reserve Bank of India to operate as a payments bank in the same year and commenced operations in November 2017. In 2021, it was granted scheduled bank status by the RBI.

History

In 2015, Paytm Payments Bank Limited was granted provisional approval by the Reserve Bank of India to establish a payments bank, and it was officially inaugurated on November 28, 2017.

During the financial year 2020, the bank facilitated more than 4.85 billion transactions, amounting to ₹4.6 lakh crore. In June 2022, it processed over 778 million UPI transactions, totaling ₹89,388 crore, and maintained its position as India’s largest UPI beneficiary bank. Furthermore, in June 2022, the bank conducted over 1.37 billion digital transactions.

In March 2021, the Securities and Exchange Board of India approved the bank’s issuance of payment mandates for initial public offerings (IPOs) through its “@paytm” UPI handle.

In June 2018, the Reserve Bank of India (RBI) prohibited Paytm Payment Bank from opening new customer accounts due to concerns raised in an audit regarding its customer acquisition process and adherence to KYC norms. However, in January 2019, the bank received approval from the RBI to resume onboarding new customers. Subsequently, in October 2021, the RBI imposed a fine of ₹1 crore on the bank for violations related to payments and settlements. On 11 March 2022, the RBI again prohibited PPBL from onboarding new customers due to significant supervisory concerns.

Following an external audit report indicating persistent non-compliance and ongoing supervisory concerns, the RBI ordered the bank to cease onboarding customers and refrain from accepting deposits, engaging in credit transactions, or making top-ups in customer accounts after 29 February 2024. This prohibition also extends to accepting additional deposits in prepaid instruments, wallets, FASTags, or National Common Mobility Cards. A press release a week later extended the deadline to 15 March 2024.

Payment Banks

About: Payment banks are a specialized type of bank introduced by the RBI in 2014. They are designed to promote financial inclusion by offering basic banking services to the unbanked and underbanked population.

They were introduced on the recommendations of the Nachiket Mor committee set up by the RBI to examine financial services for small businesses and low-income households.

Example: Airtel Payments Bank, India Post Payments Bank, etc.

Licensing Requirements:

- They are licenced under Section 22 (1) of the Banking Regulation Act, 1949

- They fall under the differentiated bank license category of RBI as they are restricted from offering the full range of services provided by commercial banks.

- RBI grants two types of banking licenses: universal bank licenses and differentiated bank licenses.

Features:

- Reserve Requirements: They are required to maintain the Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- Minimum 75% of its demand deposit balances in Statutory Liquidity Ratio eligible G-securities/ T-bills with maturity up to one year.

- Maximum 25% in current and time/ fixed deposits with other scheduled commercial banks apart from maintaining CRR requirements

- Minimum Paid-up Capital: The minimum paid-up equity capital has been fixed at Rs 100 crore.

- The promoter’s minimum initial contribution to the paid-up equity capital shall be at least 40% for the first 5 years.

Prohibited Services:

- They are prohibited from conducting lending operations or issuing credit cards.

- Therefore, they are also exempt from priority sector lending regulations that typically apply to traditional banks.

- Rural Outreach Requirements: At least 25% of a Payments Bank’s physical access points have to be in rural centers.

Major Activities Performed by Payment Banks:

- Accepting deposits from individuals and small businesses, up to a certain limit (currently set at Rs 2 lakh per account).

- Providing remittance services, and facilitating domestic money transfers.

- Issuing ATM/debit cards, prepaid payment instruments, and other electronic payment methods.

- Offering internet banking services, including online fund transfers and bill payments.

Money Laundering

Money laundering involves disguising the origins of significant sums of money obtained through criminal activities, such as drug trafficking or financing terrorism, to make them appear legal. Various illicit activities like illegal arms sales, smuggling, drug trafficking, prostitution rings, insider trading, bribery, and computer fraud schemes generate substantial profits, providing an incentive for money launderers to legitimize these illicit gains. The funds generated from criminal activities, known as “dirty money,” undergo a process known as money laundering to make them appear as legitimate earnings.

Prevention of Money Laundering Act (PMLA), 2002

The enactment of the Prevention of Money Laundering Act (PMLA) in India was a response to the country’s international obligation, particularly under the Vienna Convention, to combat the issue of money laundering. This commitment is reflected in various global agreements and initiatives, including the United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances of 1988, the Basle Statement of Principles of 1989, the Forty Recommendations of the Financial Action Task Force on Money Laundering of 1990, and the Political Declaration and Global Program of Action adopted by the United Nations General Assembly in 1990.

The Prevention of Money Laundering Act (PMLA) is a criminal law implemented to prevent and deter money laundering activities, along with facilitating the seizure of assets acquired through or linked to money laundering and associated offenses. It constitutes the primary component of India’s legal framework established to combat money laundering. The regulations outlined in this legislation apply to a wide range of financial entities, including financial institutions, banks (including the Reserve Bank of India), mutual funds, insurance companies, and their intermediaries.

2. INDIA MALDIVES REALATIONSHIP

Syllabus – GS II International relation

Why in news

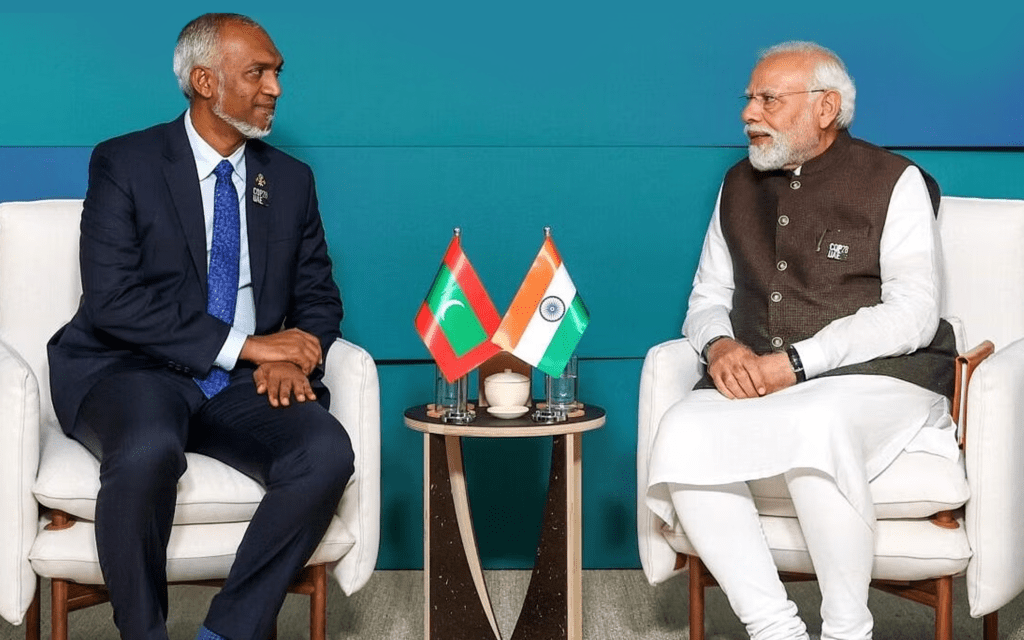

Maldives President Mohamed Muizzu has once again said that “There will be no Indian troops in the country come May 10. Not in uniform and not in civilian clothing. The Indian military will not be residing in this country in any form of clothing. The Maldives president’s remarks come on a day when Maldives signed an agreement with China to receive free military aid.

The Maldives has recently found itself in the midst of diplomatic turmoil, raising questions about its relations with India through undiplomatic remarks, military positioning, and the scrapping of crucial agreements. Maldives has also signed new deals with China, further complicating the geopolitical landscape.

Major Points Related to India and Maldives Relations

Historical Ties: The diplomatic and political relationship between India and the Maldives dates back to 1965 when the British relinquished control of the islands.

Since the democratic transition in 2008, India has invested years in building deep relationships with various stakeholders in the Maldives, including political, military, business, and civil society figures.

Maldives’ Significance for India:

- Strategic Location: Positioned south of India, the Maldives serves as a crucial gateway to the Arabian Sea and beyond, allowing India to monitor maritime traffic and bolster regional security.

- Cultural Link: India and the Maldives share deep cultural and historical connections, dating back centuries. Buddhism was prevalent in the Maldives until the first half of the 12th century, showcasing the enduring cultural ties.

- Regional Stability: A stable and prosperous Maldives aligns with India’s “Neighbourhood First” policy, promoting peace and security in the Indian Ocean region.

India’s Significance for Maldives:

- Essential Supplies: India is a key supplier of everyday essentials such as rice, spices, fruits, vegetables, and medicines. Additionally, India aids in infrastructure development by providing materials like cement and rock boulders.

- Education: Indian institutions serve as primary education providers for Maldivian students, offering scholarships for higher education opportunities.

- Disaster Assistance: India consistently provides aid during crises, including natural disasters and the Covid-19 pandemic, highlighting its reliability as a partner.

- Security Provider: India has a history of providing security assistance to the Maldives, intervening during coup attempts and conducting joint naval exercises for protection. Notable exercises include “Ekuverin,” “Dosti,” and “Ekatha.”

- Tourism Dominance: Indian tourists have emerged as the leading source market for the Maldives, with a significant 11.2% of total tourist arrivals in 2023, particularly notable amid the Covid-19 pandemic.

Major Challenges in India-Maldives Relations:

1. India-Out Campaign:Recent years have seen a political movement in the Maldives advocating for the removal of Indian influence, labeling it as a threat to Maldivian sovereignty. Key demands include the withdrawal of Indian military personnel, with the current Maldivian President setting a deadline for their departure by 15th March, 2024.

2. Tourism Strain: Diplomatic tensions have arisen between India and the Maldives due to disparaging remarks made towards the Indian Prime Minister following his visit to the Lakshadweep islands. This has led to a social media trend advocating for a boycott of the Maldives, placing strain on tourism relations.

3. China’s Growing Influence:China’s increasing presence in the Maldives, driven by its strategic interest in the region’s proximity to vital shipping lanes and India, has raised concerns in India. This rising influence has the potential to spark a regional geopolitical competition, posing challenges to India-Maldives relations.

3. SOUTH CHINA SEA

Syllabus – GS II International relation

Why in news

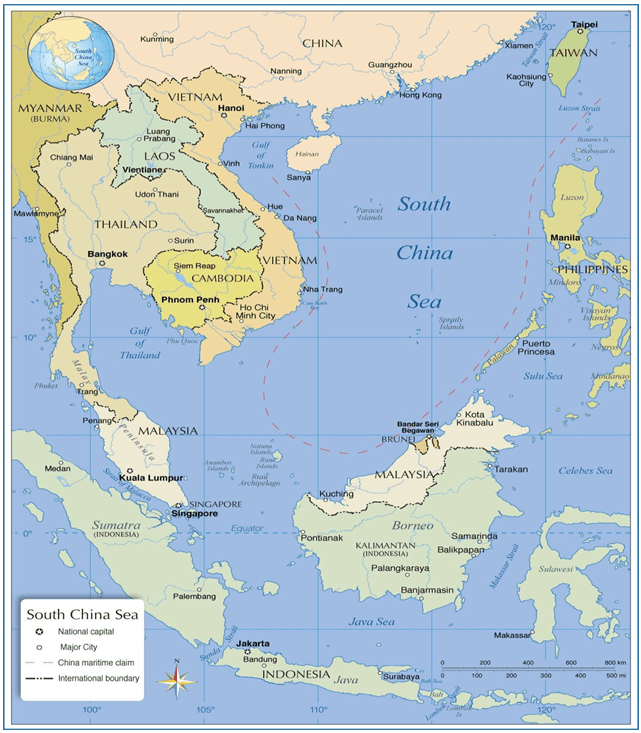

Chinese and Philippine coast guard vessels collided in the disputed South China Sea and four Filipino crew members were injured.

Description of the South China Sea:

- Geographic Location: The South China Sea is a marginal sea within the Pacific Ocean, extending from the Karimata and Malacca Straits to the Strait of Taiwan.

- Surrounding Countries: It is bordered by China and Taiwan to the north, the Indo-Chinese peninsula (including Vietnam, Thailand, Malaysia, and Singapore) to the west, and Indonesia and Brunei to the south. The Philippines lies to the east, often referred to as the West Philippine Sea.

- Connection to Other Seas: It is connected to the East China Sea via the Taiwan Strait and to the Philippine Sea through the Luzon Strait, both of which are marginal seas of the Pacific Ocean.

India’s Role in the Indo-Pacific:

- Expanding Presence: India’s growing presence in the Pacific region establishes it as a significant player in the broader Indo-Pacific area.

- Freedom of Navigation: Ensuring freedom of navigation in the South China Sea is crucial for India’s strategic interests.

- Economic Pursuits: India is actively pursuing economic opportunities in the region, including collaboration with Vietnam to explore petroleum resources in the South China Sea, despite opposition from China.

- Trade Route Significance: A significant portion of Indian trade passes through the Strait of Malacca, highlighting its strategic importance to India’s economic activities.

4. CHINA – US RELATION

Syllabus – GS II International relation

Why it’s in news : US officials stated that there will be fierce US- CHINA competition and the continued building up of strategic alliances and partnerships with countries including India.

In recent years, relations between China and the US have become increasingly confrontational. The US has pursued a more aggressive approach, instigating a Trade War and targeting Chinese technology companies, as well as challenging China’s territorial assertions. Tensions have escalated further due to concerns over human rights violations in regions like Xinjiang and Hong Kong, exacerbating the strain in relations. Despite this confrontational stance, the US has also sought cooperation with China on global challenges such as climate change, albeit maintaining a firm stance on issues related to trade, technology, and human rights

Impact of US-China Rivalry on India:

- Company Relocation: US tariffs may prompt foreign-invested companies to relocate from China, potentially leading them to move operations to India, bolstered by initiatives like Make in India.

- Capital Flows Reduction: Protectionist measures resulting from the US-China rivalry could reduce overall capital flows, impacting India’s economy.

- Opportunity for India: The rivalry presents an opportunity for India to enhance competitiveness in sectors like textiles, garments, and gems and jewellery, leveraging existing strengths.

- Weakening Rupee: Decreased capital flows may weaken the Indian rupee, increasing import costs but potentially boosting exports by making them more competitive.

- Economic Growth Concerns: Disruption of the current global economic order due to the rivalry could affect India’s exports and imports, impacting overall economic growth.

- Inflation Risks: Reduced supply of finished goods and raw materials could lead to increased consumer prices, exacerbated by higher taxes from duties, potentially causing inflation.

- Stock Market Impact: Indian stock markets may experience declines due to investor caution, coupled with potential reductions in foreign investment inflows.

5. GREEN JOBS AND THE PROBLEM OF GENDER DISPARITY

Syllabus : GS III Environment and Sustainability

Why in News :

‘Green jobs’ refer to employment opportunities that actively contribute to the well-being of the planet and promote environmental sustainability. These roles are focused on mitigating the adverse environmental effects of various economic sectors and advancing the transition towards a low-carbon economy. Occupations within renewable energy, resource conservation, and the promotion of energy-efficient practices fall under this category.

Importance:

For India, ‘green jobs’ offer significant potential, particularly in sectors like renewable energy, waste management, eco-friendly transportation, and urban agriculture. These sectors have the capacity to provide employment to a skilled workforce and contribute to the country’s sustainable development goals.

- Gender equality has been a core value for the International Labour Organization (ILO) since its inception in 1919, recognizing its importance not only as an intrinsic right but also as instrumental in achieving economic growth and poverty reduction.

- The ILO acknowledges the pivotal role of green jobs and the promotion of green economy in fostering sustainable economic and social development.

- It emphasizes the necessity of gender equality in the workforce to advance the greening of economies.

- The ILO supports integrating gender equality into broader policy agendas such as climate-resilient strategies, sustainable growth, and poverty reduction efforts.

- Strategies for developing the green economy must be fully gender mainstreamed, ensuring equal opportunities for women and men.

- The policy brief aims to facilitate discussions on integrating gender equality into green economy strategies and enhancing equal access to decent green jobs.

- Target audience includes policymakers, social partners, and ILO staff working on green jobs and green economy initiatives.

Definition of Terms

The most widely used and authoritative definition for green economy is the UNEP definition that states,

- Green economy is one that results in improved human well-being and social equity, while significantly reducing environmental risks and ecological scarcities (UNEP 2011).

- The ILO defines green jobs as “the transformation of economies, enterprises, workplaces and labour markets into a sustainable, low-carbon economy providing decent work” (ILO, 2012a)

- Decent work is defined by the ILO as being productive work for women and men in conditions of freedom, equity, security and human dignity

- Gender has been widely defined to refer to the socially constructed differences between women and men

- Gender Equality refers to women and men having equal conditions for realizing their full human rights and for contributing to, and benefiting from, economic, social, cultural and political development. It requires that women and men become full partners in their home, their workplace, their community and their society.

- Gender Mainstreaming is a strategy for making women’s as well as men’s concerns and experiences an integral dimension in the design, implementation, monitoring and evaluation of policies and programmes in all political, economic and societal spheres so that women and men benefit equally, and inequality is not perpetuated.

The shift towards environmentally friendly development, called low carbon development, has the potential to create around 35 million green jobs in India by 2047. Green jobs are good-quality jobs that help protect or restore the environment. These jobs cover various sectors like manufacturing, construction, renewable energy, energy efficiency, and automobiles. However, traditionally, these sectors have had fewer women workers.

Globally, men are expected to switch to green jobs more quickly than women. Even though India has been rapidly increasing its renewable energy capacity, women make up only 11% of workers in the solar rooftop sector. Women are mostly found working in industries like apparel, textile, leather, food, and tobacco, according to the Annual Survey of Industries 2019-20. On the other hand, men dominate sectors like infrastructure, transport, construction, and manufacturing, as per a Confederation of Indian Industry (CII) report from 2019.

A study in 2023 found that 85% of green skills training was given to men, while more than 90% of women felt that societal norms limited their participation in such training. These norms include the belief that women aren’t suitable for certain technical roles, safety concerns, fewer women studying subjects like science, technology, engineering, and mathematics (STEM), and family-related constraints.

As India moves towards a greener future, empowering women and promoting gender equality in climate actions will be crucial. Increasing women’s participation in green jobs has many benefits and can lead to a low-carbon and environmentally sustainable economy.